Market Outlook

Short-term tactical outlook

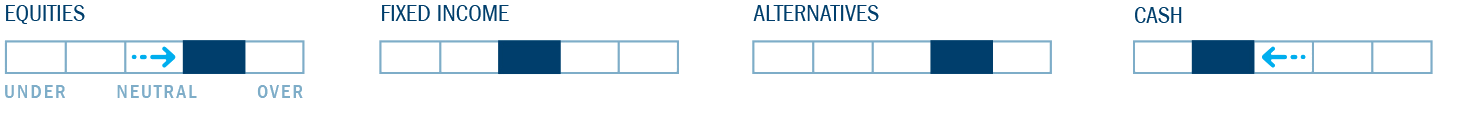

A snapshot of current views on equity, fixed-income and alternative asset classes updated monthly to help you tactically adjust for opportunities and risks.

Research Driven

Stay informed on market expectations with insights from the global asset allocation team.

Overall positions

Within equities

Within fixed income

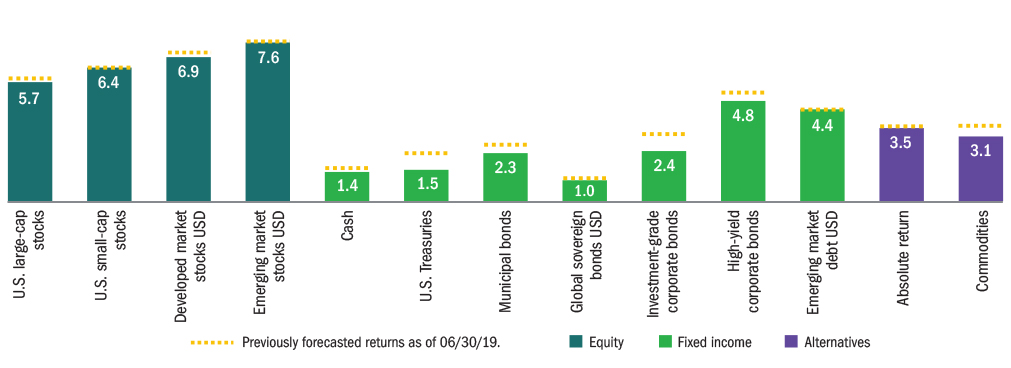

Forecasted five-year total average returns (%)*

Strategic outlook:

To calculate the five-year forecast, we usually consider three scenarios and calculate a weighted average based on the likelihood of each. But recently, Federal Reserve Board Chairman Jerome Powell acknowledged that the “neutral” rate (the short-term rate of interest that neither spurs growth nor slows it down) might be lower than the Fed’s estimates. This is contrary to the optimism we saw in the financial markets post tax cuts, when many assumed that 2017 tax rate changes would result in more permanent productivity enhancements. Accordingly, we removed the third scenario of faster growth from our assessment.

Most likely (70%): Growth slows to trend levels

Our base case assumes that U.S. growth slows to trend levels. According to the Congressional Budget Office and our own analysis, it would be in the range of 1.8%–2.0% , the supply-side estimate of growth based on demographics and productivity.

Less likely (30%):

Trade disputes and protectionism In this scenario, we might see our slow-growth economy succumbing to disruptions and enter a recession. Theory suggests that inflation initially rises, but tariffs and subsequent recessions are eventually deflationary.